Background

In 2018, there were two significant changes in Financial reporting. The first one being IFRS 15 – Revenue from contract with customers and the lesser discussed one IFRS 9 – Financial instruments.

These new standards are mandatory for annual periods beginning on or after 01st January 2018

IFRS 9 – Financial Instruments has replaced the existing IAS 39 and brought stringent provisions with regard to impairment to prevent surprise write offs in the time of crisis. It is going to have a big transitional jolt on Banks and financial institutions’ balance sheet as retained earnings are adjusted to accommodate retrospective increase in impairment loss allowances, post implementation it will bring more volatility in the Income statements.

Impairment

Impairment means a permanent reduction in recoverable value of an asset below its book value. Financial instruments such as loans are often impaired below their book value in the event of default. Therefore it is imminent to provide for these impairment losses in books.

During the financial crisis it was discovered that Banks’ Balance sheets were not fully reflecting the expected losses due to credit defaults. This delayed recognition led to a pressing need to bring new standard with a forward looking “Expected credit loss” model, a paradigm shift from the “Incurred Loss” model followed under IAS 39.

Expected credit loss Model

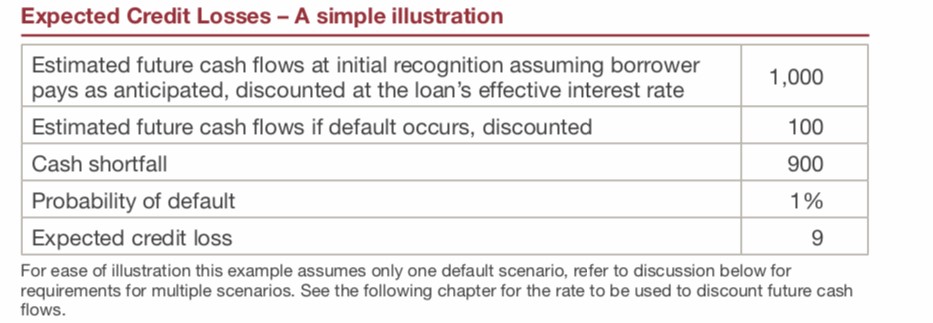

This model focuses on the risk that loan will default rather than whether a loss has been incurred. It takes into account the probability of default, time value and forward looking information. This however brings more subjectivity and judgement in the loss allowances, therefore the standard requires extensive disclosures about inputs, assumptions and techniques used in estimating ECL to aid in understanding and comparison of Financials and thus bringing transparency.

Logic

The new requirements tilts the accounting to conservatism and is on the lines of matching principle.

Matching concept advocates matching of incomes with the expenses attributable to earning those incomes. A loan contract carries an Interest rate, which inherently includes the credit risk premium, Lower credit worthiness means higher risk resulting in higher Interest rates.

The Interest income we recognize includes a portion of premium for taking the credit risk therefore the expected losses due to this risk should also be recognized along with the risk premium earned for the same.

Application of ECL model

It Applies on Debt instruments recorded at Fair Value or FVTOCI.

The amount of ECLs recognised as a loss allowance or provision depends on the extent of credit deterioration since initial recognition, Impairment is divided into 3 stages depending on the severity or lack of credit deterioration

- Stage 1: 12 Month ECL

Trigger: Day 1 of entering into the financial contract.

Applied on: All items. (Credit impaired or not)

Provision amount: Losses that might occur due to possible default event within next 12 months

Cash shortfall * Probability of default in next 12 months

- Stage 2: Lifetime ECL

Trigger: Significant increase in credit risk

Rebuttable presumption: 30 days overdue

Treatment: Provide for lifetime losses

Provision amount: Total Expected losses – Impairment already recognized under stage 1

EIR: Calculated on Gross Carrying amount.

- Stage 3: Lifetime ECL

Trigger: A credit default has taken place

Treatment same as stage 2 except for EIR Calculation as below

EIR: Calculated on (Gross carrying amount – loss allowance)

Thank you for reading!

CA Divakar Dadhich